- As of 2020, there were approximately 69,709 independent publishers in the book industry worldwide.

- Within North America, independent publishers contribute greatly to the region’s 35% market share in book publishing.

- For the US, hundreds of millions of books are sold each year by independent publishers.

- In total, indie books account for around 40% of commercially available books.

- As of 2022, 50% of independent book publishers found accounting their top business challenge, followed by freelance contractors (48%) and royalties (45%).

- However, the top three concerns raised were securing distribution (39%) returns (35%) and understanding distribution fees (27%).

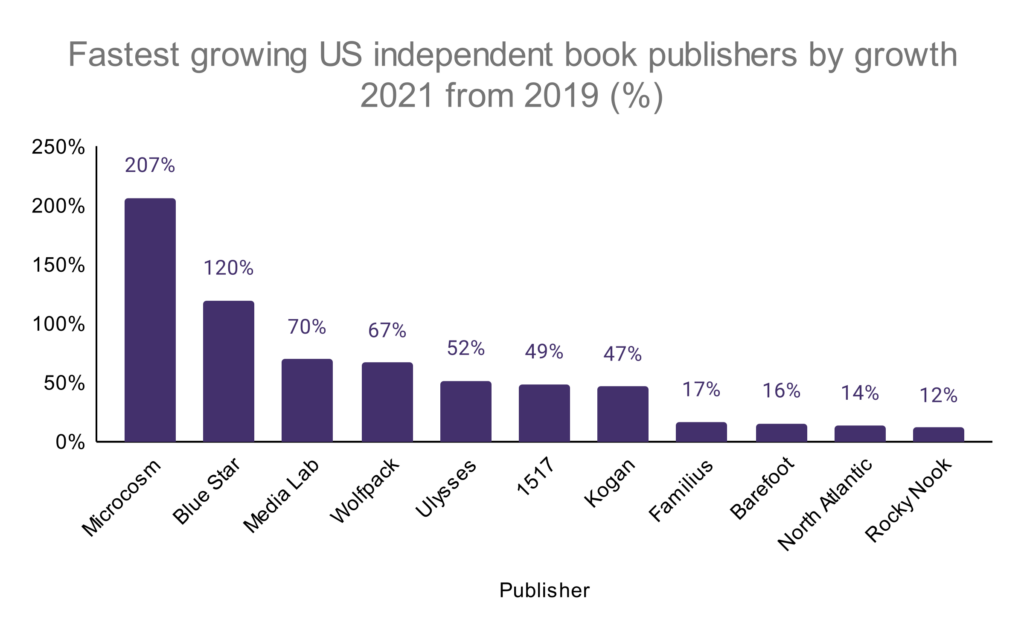

- The fastest growing US indie book publisher as of 2021 was Microcosm Publishing, followed by Blue Star Press (2nd) and Media Lab Books (3rd).

- Microcosm’s sales for the year of 2022 were $4.2 million.

- Since its publication in 2017, Microcosm’s “Unf*ck Your Brain” has sold five million copies in all formats.

- The title contributed to 10.73% (approximately $450,000) of the company’s total sales for 2022.

Fastest growing US independent book publishers

By growth

- Microcosm Publishing was the fastest growing US indie book publisher as of 2021 with a sales growth of 207%.

- Blue Star Press was the second fastest growing US indie book publisher as of 2021 with a sales growth of 120%.

- Media Lab Books was the third fastest growing US indie book publisher as of 2021 with a sales growth of 70%.

| # | Name of publisher | Sales growth 2021 from 2019 |

| 1 | Microcosm Publishing | 207% |

| 2 | Blue Star Press | 120% |

| 3 | Media Lab Books | 70% |

| 4 | Wolfpack Publishing | 67% |

| 5 | Ulysses Press | 52% |

| 6 | 1517 Media | 49% |

| 7 | Kogan Page Inc. | 47% |

| 8 | Familius | 17% |

| 9 | Barefoot Books | 16% |

| 10 | North Atlantic Books | 14% |

| 11 | Rocky Nook | 12% |

A graph to show the fastest growing US independent book publishers by growth is given below:

By number of employees

- The highest number of employees for 2021 was found at 1517 Media, with 43 employees.

- The lowest number of employees for 2021 was found at Kogan Page Inc., with 5 employees.

- In terms of the biggest percentage increase in 2021 from 2019, Microcosm registered a 107.14% increase in employees.

- Both Media Lab Books and Ulysses Press showed no change in staff numbers for the two periods.

| # | Name of publisher | Employees 2019 | Employees 2021 | Change |

| 1 | 1517 Media | 35 | 43 | + 22.86% |

| 2 | Barefoot Books | 19 | 29 | + 52.63% |

| 3 | Microcosm Publishing | 14 | 29 | + 107.14% |

| 4 | North Atlantic Books | 24 | 25 | + 4.17% |

| 5 | Media Lab Books | 19 | 19 | = |

| 6 | Wolfpack Publishing | 8 | 16 | + 100.00% |

| 7 | Ulysses Press | 13 | 13 | = |

| 8 | Blue Star Press | 5 | 9 | + 80.00% |

| 9 | Familius | 8 | 9 | + 12.50% |

| 10 | Rocky Nook | 7 | 8 | + 14.29% |

| 11 | Kogan Page Inc. | 3 | 5 | + 66.67% |

A graph to show the fastest growing US independent book publishers by employees is given below:

By number of new titles

- The highest number of new titles published during 2021 was found at Wolfpack Publishing, with 322 new titles.

- The lowest number of new titles published during 2021 was found at Media Lab Books, with 18 new titles.

- In terms of the biggest percentage increase in 2021 from 2019, 1517 Media registered a 57.69% increase in the number of new titles.

- Both North Atlantic Books and Rocky Nook showed no change in the number of new titles for the two periods.

| # | Name of publisher | New titles 2019 | New titles 2021 | Change |

| 1 | Wolfpack Publishing | 212 | 322 | + 51.89% |

| 2 | 1517 Media | 104 | 164 | + 57.69% |

| 3 | Kogan Page Inc. | 104 | 119 | + 14.42% |

| 4 | Ulysses Press | 45 | 67 | + 48.89% |

| 5 | Familius | 58 | 57 | – 1.72% |

| 6 | North Atlantic Books | 39 | 39 | = |

| 7 | Rocky Nook | 28 | 28 | = |

| 8 | Microcosm Publishing | 26 | 27 | + 3.85% |

| 9 | Blue Star Press | 20 | 25 | + 25.00% |

| 10 | Barefoot Books | 16 | 20 | + 25.00% |

| 11 | Media Lab Books | 12 | 18 | + 50.00% |

A graph to show the fastest growing US independent book publishers by new titles is given below:

Microcosm Publishing

- Total sales for Microcosm Publishing was $4.2 million during 2022.

- “Unf*ck Your Brain” by the publisher has sold five million copies across all formats since its 2017 publication.

- The title contributed to 10.73% of the company’s total sales in 2022.

Blue Star Press

- Blue Star Press entered into a partnership with Penguin Random House Publisher Services in 2019, a factor that played a huge role in their 2021 sales gains.

- Since the company’s formation in 2015, Blue Star Press has published more than 200 books.

- During 2021, Blue Star Press published 25 new titles.

Media Lab Books

- Media Lab Books publishes numerous titles across the cooking/drinking, children/ya and puzzles/games genres.

- As of 2021 Media Lab Books’ top-selling releases were:

- “The Unofficial Harry Potter Bestiary” (50,000 copies sold).

- “The Game Master’s Book of Non-player Characters” (42,000 copies sold).

- “The Official John Wayne Handy Book of Bushcraft” (15,000 copies sold).

- The company increased its sales growth by 70% for 2021 from 2019.

A graph is given below to show Media Lab Books’ number of new titles per year:

Wolfpack Publishing

- Although the company started by publishing primarily western fiction, they have expanded to include thrillers, historical romance, christian romance and more.

- Wolfpack Publishing also owns three imprints, CKN Christian Publishing, Wise Wolf Books and Rough Edges Press, alongside an audiobook production division.

- As of 2021, Wolfpack has almost 2,000 backlist publications listed.

- It is estimated that 30% of Wolfpack’s releases are new books.

- The publisher focuses heavily on selling e-books. As such, the vast majority of the company’s revenue comes from online retailers.

- As of 2021, 17% of its sales were print books.

Ulysses Press

- Ulysses Press represents a vast range of book genres, from cooking to pop-culture, self-help and more.

- The publisher approaches book acquisitions by focusing heavily on data and research.

- Ulysses Press looks to identify and represent niche genres in the book market.

- For younger readers, the publisher also owns the Bloom Books imprint.

- 67% of Ulysses Press’ revenue for 2021 was from backlist titles.

- In 2021, Ulysses Press released “The Unofficial Hocus Pocus Cookbook”, which sold 70,000 copies during the year.

- “Prepper’s Long-Term Survival Guide” sold 38,000 copies in 2021 and has sold more than 132,000 copies since its release date in 2014.

1517 Media

- 1517 is a publishing house originally known as Augsburg Fortress Press

- It is associated with the American Evangelical Lutheran Church and owns multiple imprints:

- Beaming Books for the children’s market

- Broadleaf Books for the adult nonfiction market.

- Fortress Press for academic and reference titles.

- Sparkhouse for religious educational resources.

- Beaming Books and Broadleaf Books published 79 titles in 2021.

- Sales in 2021 for the two imprints jumped 114% when compared to 2019.

- 55% of 1517’s book publishing revenue for 2021 was accounted for by the two imprints.

- However, Fortress Press still remains as the largest imprint overall for 1517 Media.

Kogan Page Inc.

- Kogan Page Inc. was established in 2019 in New York by Kogan Page (UK) to reach the US and Canadian markets.

- The publisher specializes in academic books, educational books and books for professionals.

- The company began shifting its focus from physical to digital sales at the start of 2020.

- This change helped Kogan Page Inc. achieve strong increases in revenue across both print and digital formats.

- As of 2021, its new bestsellers include “Brand Storytelling”, “The End of Marketing” and “Artificial Intelligence for HR”.

- Alisa Cohn’s book “From Start-Up to Grown-Up” became one of the company’s best sellers to date, despite being published in October 2021.

Familius

- Familius looked to increase profitability for the period 2019 – 2021 by keeping its number of new titles published low.

- As of 2021, Familius published 57 new books. The publisher aims to release a similar number of new books annually in upcoming years.

- Familius doubled its digital sales during the year, by investing more heavily in e-book and digital platforms.

- The publisher also implemented a plan to increase non-returnable business. As such, it targeted and achieved increased sales in specialist and gift stores.

- By reducing returns by 7%, non-returnable sales represented the largest percentage of the publisher’s revenue.

- Backlist titles represent almost 70% of sales for Familius as of 2021.

A graph is given below to show Familius’ number of new titles per year:

Barefoot Books

- Barefoot Books is a children’s publisher that encourages global and social awareness.

- As of 2022, the company has published more than 1,000 books since 1992.

- The publisher also partnered with Books4School to provide 1 million books spanning 20 languages to children.

- As of 2021, sales for the publisher increased 16% when compared to 2019.

- Despite the company experiencing a slight dip overall in 2020, subscription box sales grew for Barefoot Books by more than 200%.

- Backlist sales for the company have increased, accounting for 85% of revenue during 2021.

- A rising demand for children’s wellness books has been cited as a possible factor for this sales increase.

North Atlantic Books

- North Atlantic Books have predominantly published across the genres of health and wellness, racial justice and self-healing.

- The publisher also owns the imprint Blue Snake Books, which focuses on martial arts publications.

- As of 2021, North Atlantic’s sales increase was primarily due to high backlist and digital sales.

- Digital sales made up 22% of 2021’s revenue, an increase of 17% from 2019.

- Within digital, audiobooks continued to record good sales numbers, with a 50% increase over the 3-year period.

- Backlist sales generated 82% of 2021’s sales, an increase of 78% since 2019.

- North Atlantic’s backlist top seller for 2021 was “Modern Herbal Dispensatory” which sold 48,500 copies, 92.78% of which were print and 7.22% were digital.

- “Postcolonial Astrology”, was the company’s frontlist top seller, selling 11,000 copies in total.

- North Atlantic’s “Healing with Whole Foods: Oriental Traditions and Modern Nutrition” has achieved more than 600,000 sales to date.

Rocky Nook

- Rocky Nook is best known for producing books on educational photography.

- The publisher has achieved back-to-back record sales for the years of 2020 and 2021.

- As of 2019, the company began diversifying its business by seeking new authors and different topic areas.

- As a result of this, 26% of the publisher’s 2021 revenue came from titles outside of its main genre.

- The “Morpho” series on how to draw the human anatomy became a viral social media trend, driving 2021 sales.

- Another backlist title, “The Photographer’s Guide to Posing” from Rocky Nook’s core genre, has sold 10,000 copies since its publication in 2017.

Independent book publishers FAQ

Why do authors use independent book publishers?

- Indie book publishers provide an option for those who do not have publishing agreements with the largest recognized publishers.

- Furthermore, authors look to independent book publishers in order to gain more creative freedom when compared to large publishing houses.

What do independent publishers offer differently?

- Independent publishers provide a different type of opportunity for authors, as they are often able to offer a more diverse range of publications through niche genres.

Why are independent publishers successful?

- A key factor in the success of independent publishers is that they are often primarily or completely digital, which helps to increase their sales numbers.

- Furthermore, indie publishers are smaller and can find that they have more freedom to take risks, which would not be feasible in the largest publishing houses.