The worldwide pandemic outbreak in 2020 left significant consequences on consumers’ behavior and human behavior in general. While a lot of physical stores closed, e-commerce had a massive expansion during 2020, growing “10 years within a few months”.

While remaining relatively stable during the peak pandemic year, the book market also witnessed some changes. In this report, we’ll examine how book sales progressed during 2020 and the aftermath of the Covid-19 impacted year.

- In the US book market, people with greater purchasing power tend to read more than lower-income people:

- On average, people who earn more than $1,080 per week spend almost 90 minutes per week reading for pleasure.

- On the other hand, people who earn under $1,080 per week read less than 50 minutes per week.

- At the same time, the top 10% of earners in the US spent almost 25% of the total book expenditures in 2020.

- In 2021, the difference between top and bottom earners was even bigger, with the top 10% of earners accounting for almost 25% of all book purchases.

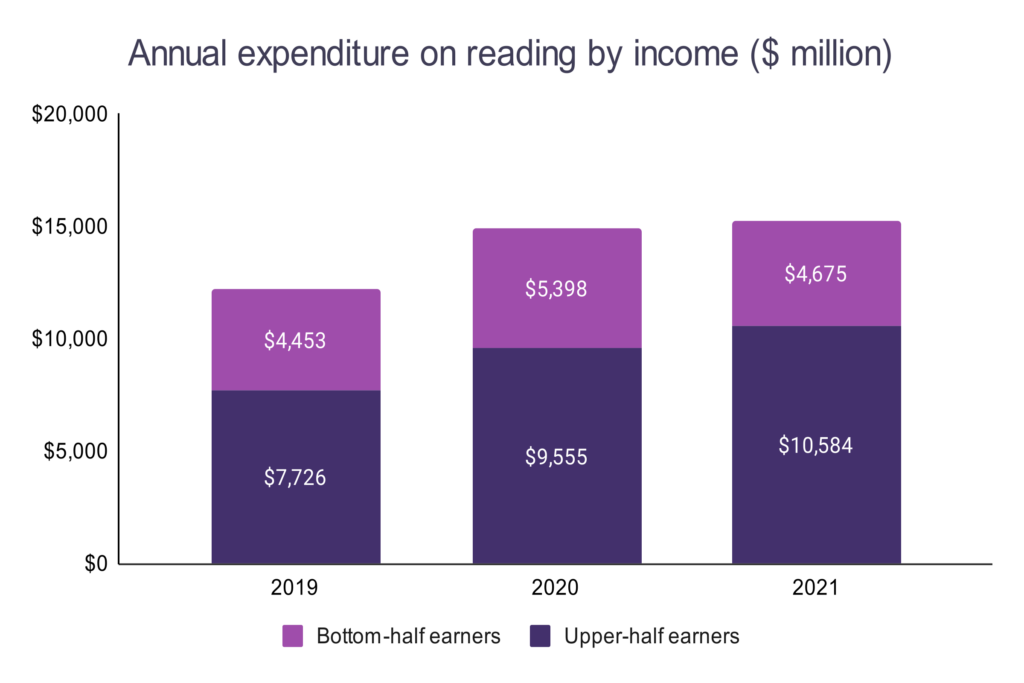

- Americans spent more on reading in 2020 than they did in 2019, increasing expenditures from $12.17 billion in 2019 to $14.95 billion in 2020, a 22.9% increase.

- Reading expenditures continued to increase in 2021, as Americans spent $15.23 billion on reading, 1.85% more than in 2020.

| Year | Total expenditure on reading in the US ($ million) | Change |

| 2021 | $15,229 | 1.85% |

| 2020 | $14,953 | 22.90% |

| 2019 | $12,167 | -14.18% |

| 2018 | $14,178 |

One of the main reasons why the book sales remained solid, or even increased, during Covid was the fact that the wealthier citizens started to spend more on books. But the lower-income citizens also didn’t shy away from this trend:

- The total amount of money that the upper 50 percentile Americans in terms of income spent on reading jumped from $7.72 billion in 2019 to $9.56 billion in 2020, and eventually to $10.56 billion in 2021.

- This annual increase was 23.7% in 2020 over 2019 and 10.8% in 2021 over 2020.

- In total, upper-half earners in the US accounted for 69.5% of all reading expenses in the country in 2021, a 9.45% jump over 2019 when they accounted for 63.5%.

- At the same time, bottom-half earners also spent more on reading, though at a lower rate – spending $4.45 billion in 2019 and $5.4 billion in 2020.

- However, in 2021, bottom-half earners lowered their spending on reading down to $4.7 billion.

| Year | Bottom-half earners’ expense on reading ($ million) | Upper-half earners’ expense on reading ($ million) |

| 2021 | $4,675 | $10,584 |

| 2020 | $5,398 | $9,555 |

| 2019 | $4,453 | $7,726 |

| 2018 | $5,515 | $8,649 |

Covid-19 and print book sales

American print book market didn’t share the unfortunate fate of some other industries during Covid. In fact, print book sales soared during pandemic, even though physical stores had a hard time:

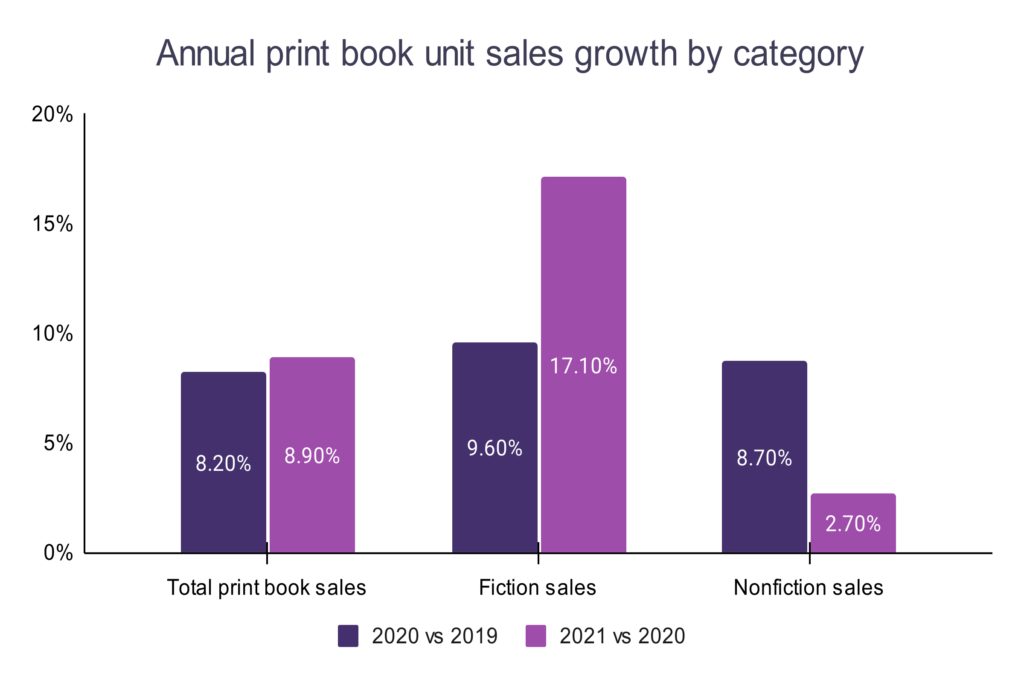

- In 2020, over 750.9 million print books were sold in the USA, representing an 8.24% increase over 2019.

- Nonfiction books lead the growth, mostly in the juvenile category, which grew 23.1% in 2020 over 2019, and YA nonfiction, which grew 38.3%.

- However, all categories of print books, both fiction and nonfiction, across all age groups sold more copies in 2020 than in 2019.

- 2021 saw even larger growth in print book sales, 8.9% year-over-year, compared to 8.2% growth in 2020 over 2019.

- This time, fiction was the category that was the driving force behind growth, as adult fiction sales grew 25.5% and YA fiction by 30.7%.

- Similar to 2020, all categories across all age groups recorded an increase in sold units except for juvenile nonfiction.

Digital book sales during Covid-19

As a consequence of lockdown during 2020, digital book sales grew significantly. Ebooks had a particularly good year:

- In 2020, over 191 million ebooks were sold in the United States. This is a significant jump from 2019 when 170 million units were sold.

- 2020 also recorded the highest ebook sales figures since 2015, the last year when more than 200 million ebooks were sold.

- Ebook revenue increased in 2020 over 2019 by 12.4% to $2.07 billion. However, ebook sales dropped in 2021 by 5% to $1.97 billion.

- Audiobooks didn’t have as big of a leap as ebooks did in 2020, but they still sold around $100 million more than in 2019.

- In 2021, audiobook revenue grew by 12.8% to around $1.75 billion.

Impact of Covid-19 on bookstore sales

Unlike book market, which managed to remain stable or even grow during the pandemic years, bookstores are the segment that probably suffered the most during this period.

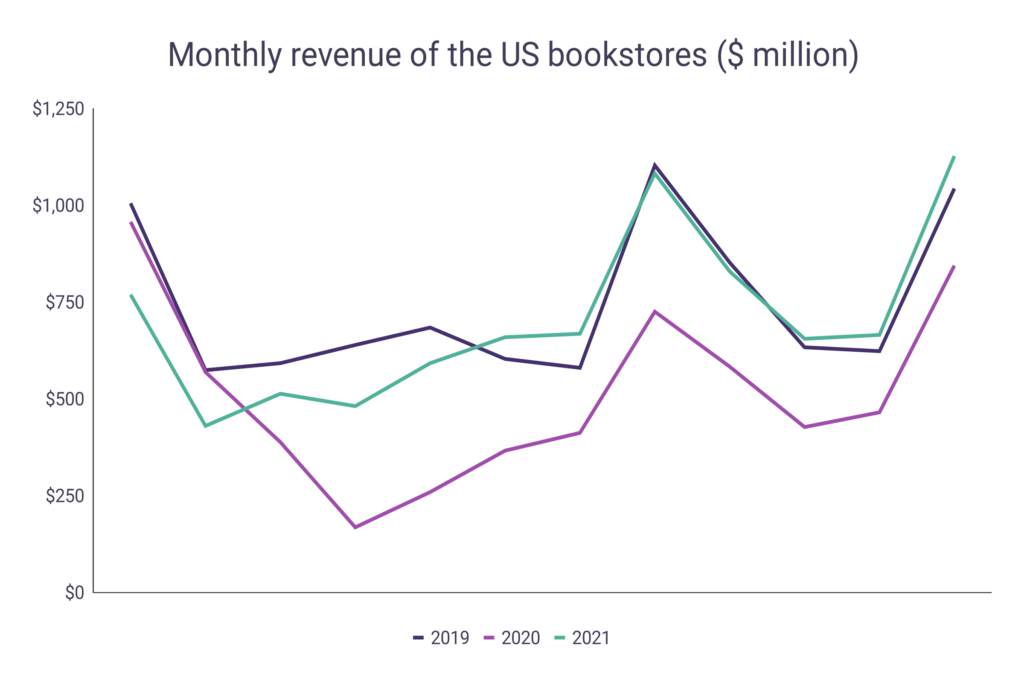

- In 2019, the US bookstores reported revenue of $8.93 billion. A year later, the revenue dropped by 31% down to $6.16 billion.

- Even though 2021 saw a 37% increase over 2020, the revenue figures in 2021 were still below the pre-pandemic level, at $8.47 billion.

- Looking at monthly YOY changes, the worst period for US bookstores were April and May 2020, when the sales revenue declined by 73.7% and 62.1% YOY, respectively.

- From March to December 2020, a monthly YOY change in revenue of US bookstores never fell under 25%.

- Bookstore revenue started to recover only from March 2021, when the revenue increased by 32.2% YOY.