The educational industry is among the biggest industries in the world, worth over $3,000 billion globally. The publishing segment of education, while only a small portion of the industry, still generates dozens of billions of dollars every year.

Educational books, along with professional books, account for around 40% of the book publishing industry. Trade books hold the remaining 60% of the book publishing market. In this report, we take a closer look into the educational publishing industry, with a specific focus on the textbook market.

Educational publishing market

Globally, educational books are going through a huge transformation. The Covid-19 pandemic accelerated the emergence of digital textbooks and other learning materials and solutions.

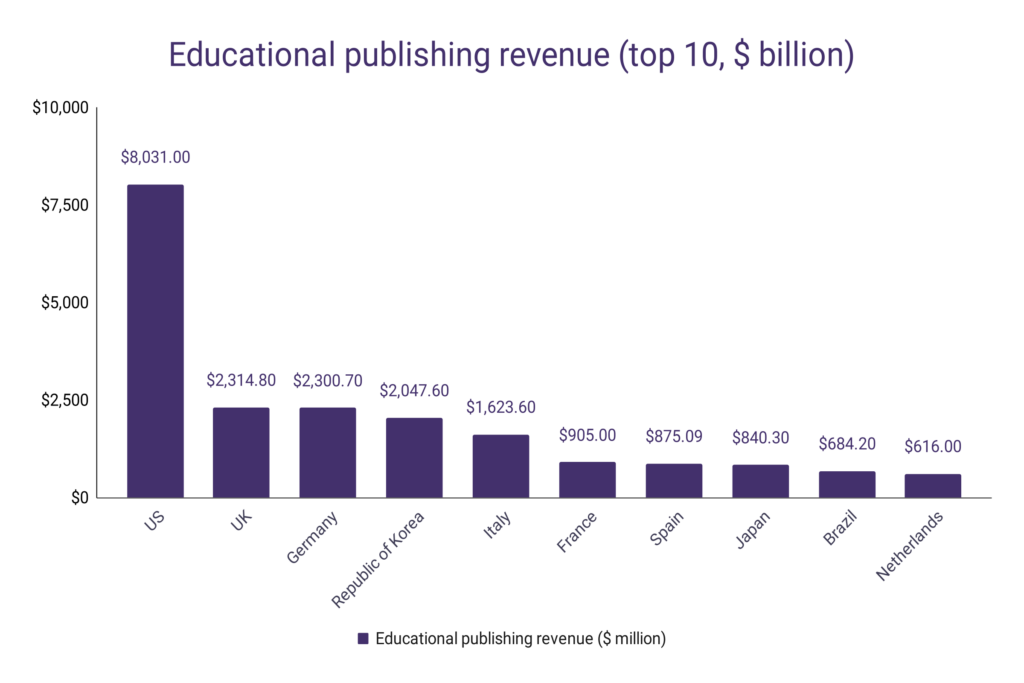

- In the United States, educational books generate over $8.03 billion in revenue, accounting for 27.4% of the book sales revenue in 2021.

- There is a potential market of 67.6 million students in the US

- 48 million public school students are in Kindergarten to 12th grade

- 19.6 million students are enrolled in higher education in the US

- The amount of students enrolled in higher education is predicted to grow by 14% over the next 5 years.

- In Europe, textbooks generate around $6 billion annually. School textbooks, along with professional materials, generate over $4.85 billion.

- Along with the United States, the biggest educational book markets in the world are the UK, Germany, the Republic of Corea, and Italy, all generating over $1 billion annually.

- In terms of how big is the educational market compared to the publishing industry overall, Mexico, Netherlands, Brazil, Denmark, Turkey, and Colombia are countries that generate most of their publishing revenue from the educational segment.

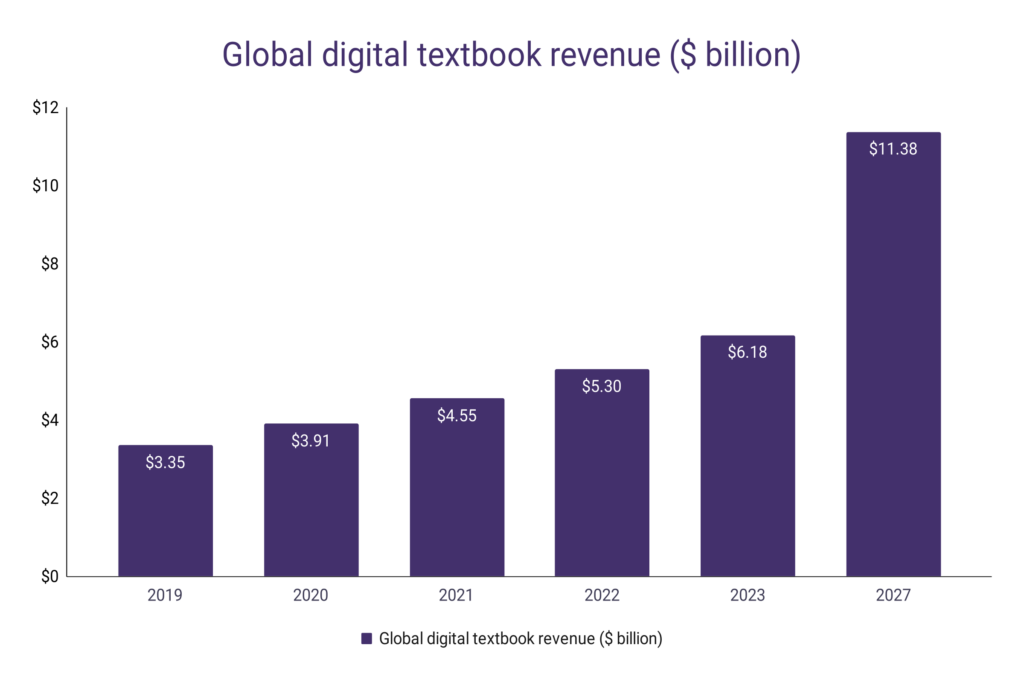

Among the textbook segment, digital textbooks are the driving force behind the industry’s growth.

- The global digital educational publishing market will grow by 17% annually by 2027, rising from $15.74 billion in 2023 to $29.5 billion.

- Texts in digital educational material generate over $5.3 billion annually and are projected to reach $11.38 billion in 2027.

Textbook sales

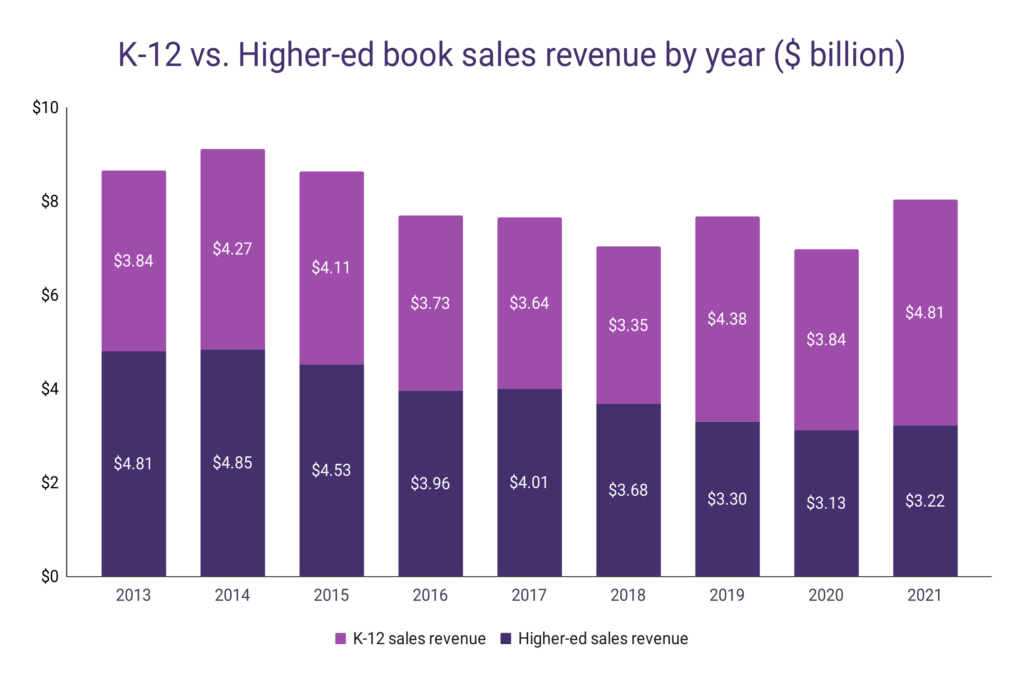

Looking at US book publishing as a whole, textbook sales are growing slower than trade and professional books. In 2013, over 31.9% of all book sales in the US were generated from textbooks, while in 2021 this share dropped to 27.3%.

However, not all textbooks within the segment follow the same trend:

- College textbooks generated $3.22 billion in sales in 2021, while in 2013, they generated over $4.81 billion.

- Over the last 5 years, college textbook revenue dropped by 19.7%, declining 33% since 2013.

- On the other hand, preK-12 textbook sales are 32.1% higher in 2021 than in 2016 and over 25.2% higher than in 2013.

- In 2013, preK-12 textbooks accounted for 44.3% of the textbook revenue in the US, while college textbooks generated 55.6% of the revenue.

- In 2021, college textbooks account for only 40% of the educational book sales in the US, while preK-12 textbooks make up for 60% of the revenue.

Digital textbooks vs. physical textbooks

- Between 1977 and 2015, the cost of textbooks increased by over 1000%.

- Textbook costs rose 67% from 2008 to 2018.

- 75% of students prefer a print textbook over a digital one if the price isn’t a factor.

- 60% of students would rather pay $20-40 for a print textbook than get a digital version for free.

- 23% of students purchased at least one digital textbook in the past academic year.

- 41% of colleges believe their students learn better from print textbooks than digital ones.

- 32% of the Danish textbook market stems from sales of digital content.

- 100% of French textbooks have been digital since 2008.

Educational publishers

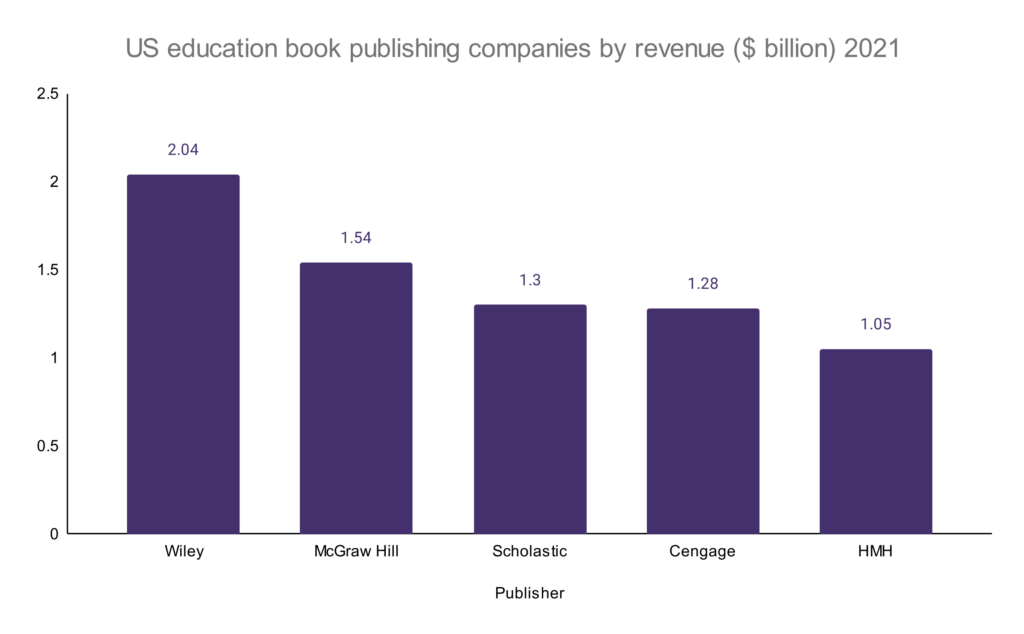

Educational publishing companies generated over $16 billion in the United States in 2022. Among the biggest players, who control the majority of the market, the biggest payers are Scholastic, McGraw Hill, Wiley, Cengage, Pearsons, and others.

- The biggest educational publisher in the US is Pearson Education, selling over $4.71 billion worth of educational solutions and accounting for ~40% o the market share.

- Scholastic generates over $393 million in revenue from its educational division and grows by 26.4% compared to 2020.

- Houghton Mifflin Harcourt generates $1.05 billion as of 2021, an increase of $165 million over 2020.

- Wiley is among the biggest education publishers in the United States, generating over $2 billion annually.

- Cengage is another company that accumulates over $1 billion in revenue from educational solutions, selling over $1.28 billion worth of products.

- McGraw Hill is the second largest publisher in the US when it comes to educational books, generating more than $1.54 billion annually.